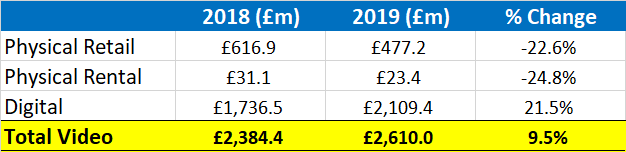

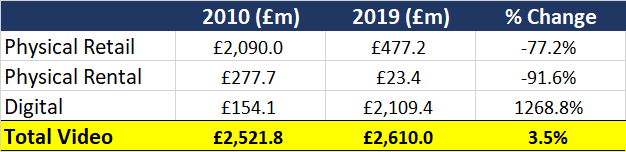

At the beginning of the last decade, according to the Entertainment Retailer’s Association, the annual UK video market – comprised of physical retail, physical rental and digital – was worth just over £2.4bn. By 2019, this had grown to £2.6bn.

And whilst in 2010 Brits were buying over £2bn of TV shows and movies to own and keep, by 2019 this spend had shrunk 77% to £477m. Physical rental had evaporated even more rapidly, 92%, from £278m to £23m. Digital, however, made up of SVOD and TVOD (but not including PPV and specialist sports) grew over 1,200% to £2.1bn.

These numbers tell us, I think, two things. First, that the owner-renter-streamer model seems to have almost inverted over the past ten years. £477m in physical sales is still significant but it’s clear that for video, consumers are becoming increasingly comfortable in not buying to keep; confident that, with a short wait as premium content passes through the pay windows, they’ll always find something to watch on the services they subscribe to.

Second, and rather more worryingly for broadcasters, film studios, operators and service-providers, is the relative lack of growth in the market overall. Consumers have transferred their physical rental spend almost entirely from Blockbusters to Netflix, Amazon and Sky (via NOW TV) but their budgets haven’t expanded to spend much more (only 3.5% more says the ERA) on video. Will that change now as Apple, Disney, NBCU and WarnerMedia enter the arena?

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.