One of the most striking things about our OTT Question Time Live conferences is how much appetite there is for sharing knowledge, insights, and hard-won lessons — even (perhaps especially) among senior industry figures. I guess it’s a truism that while companies compete, people collaborate.

With that spirit in mind, I wanted to create a more structured way to capture the thinking of key decision-makers across the streaming landscape. That was the genesis of our first OTT Leaders’ Sentiment Survey, which we ran last month.

About a third — 48 — of the senior executives we approached (most of whom have been working in the industry for 15+ years) anonymously completed a detailed questionnaire about both their own organisations and the wider market.

They shared their views on where they think the industry is headed, which growth areas excite them most, the biggest challenges they face, and how they’re adapting. We asked about priorities across content, commercial models, technology, product, operations, and strategy — and, crucially, how confident they feel about the months ahead.

What emerged is a fascinating snapshot of a sector at an inflection point (isn’t it always?): mature in some respects, still evolving in others, and grappling with pressures that vary by market position.

Some respondents were cautiously optimistic, others were bracing for consolidation, but nearly all focused on profitability, resilience, and sharpening their competitive edge.

The full report (available for purchase on its own or as part of our VOD Pro+ premium channel) unpacks these findings, highlights key sentiment trends, and offers commentary on what they might signal for the near future. Whether you’re a broadcaster, streamer, tech provider, or advisor, you’ll find insights here to help refine your thinking and spark meaningful conversations.

A free-to-download executive summary is also available.

Highlights include:

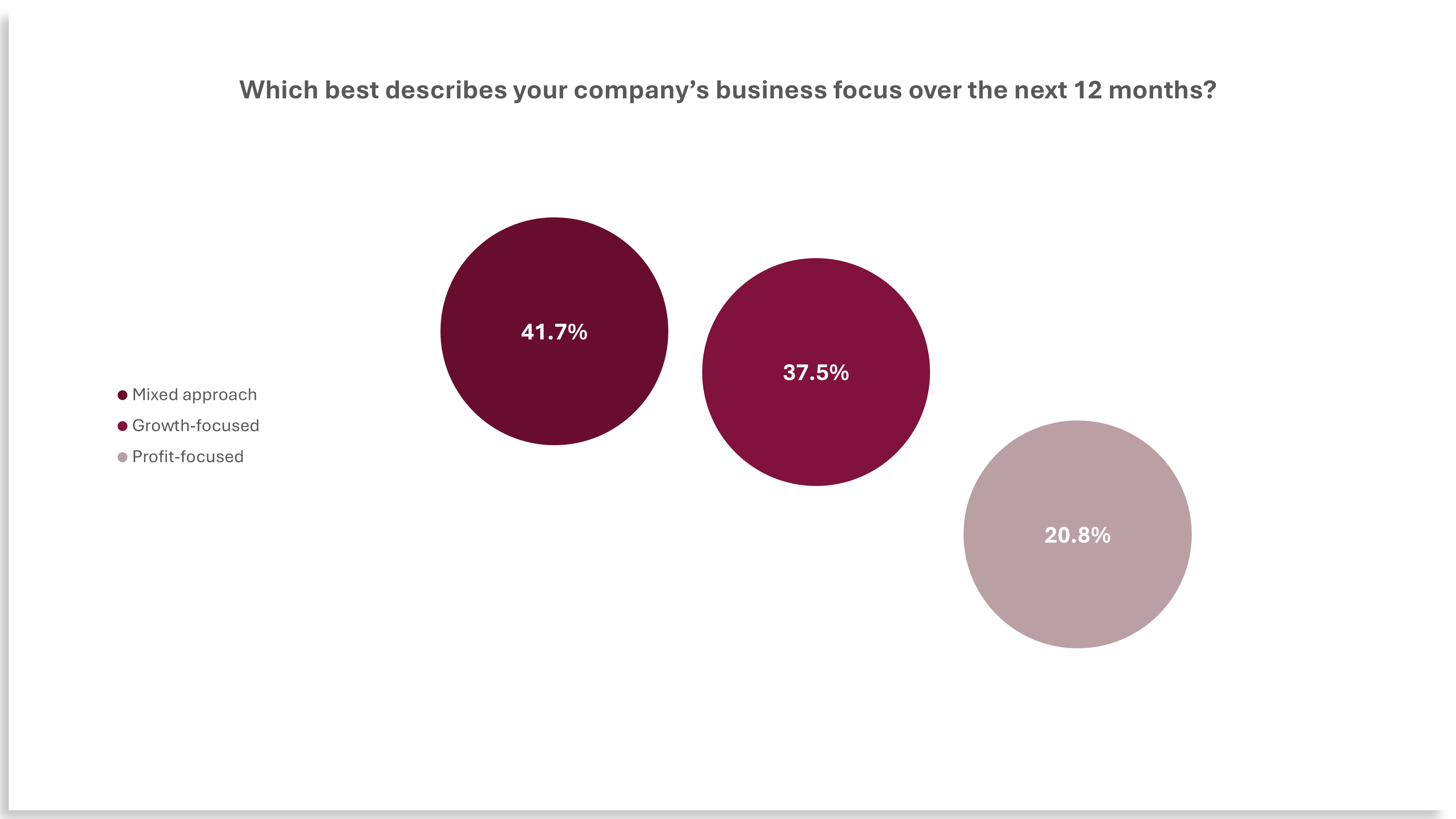

- Contrary to the sentiments we might have read about the big guns (Disney+, Netflix etc.), only 21% of streamers are focused on profit this year

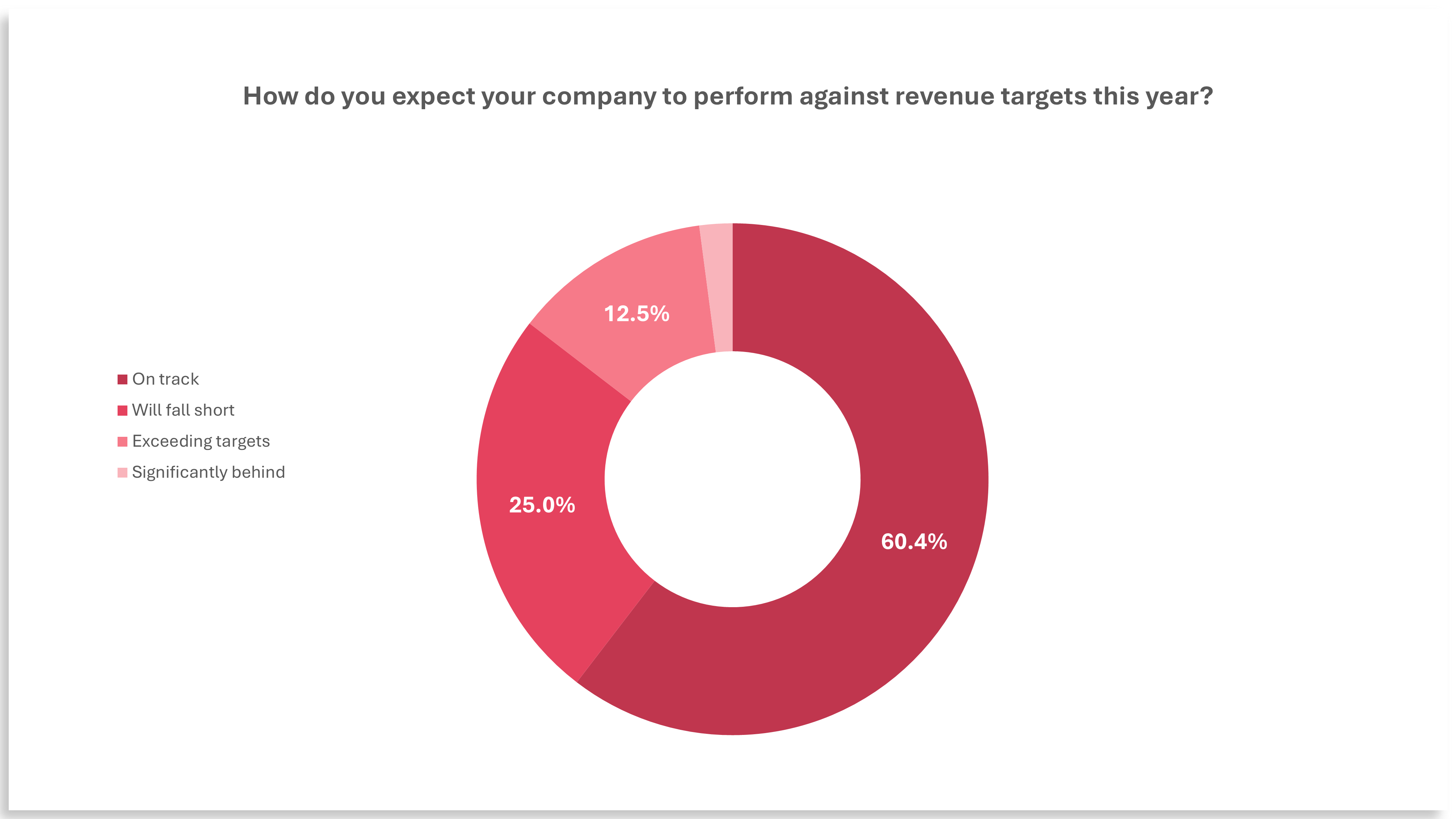

- While 60% of respondents say they’ll hit their revenue targets this year, 25% expect to fall short

- Increasing ad loads or introducing dynamic pricing is seen as the second biggest revenue opportunity; at the same time, ad revenue volatility is regarded as the biggest threat

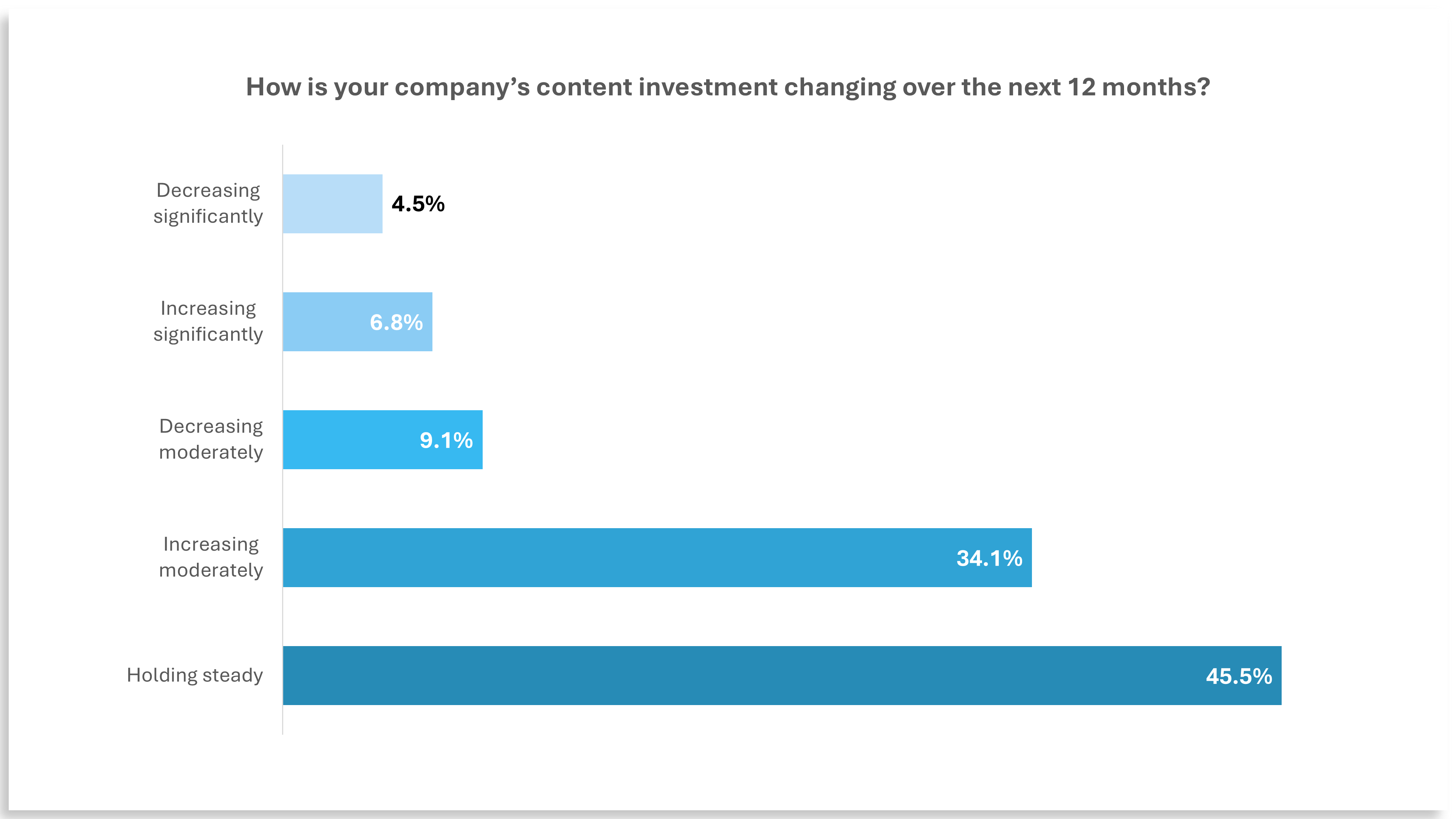

- 80% of content budgets are either holding steady or moderately increasing (though this was before last weekend’s news that President Trump may impose 100% tariffs on movies “produced in foreign lands”)

- Discovery and recommendations (that old chestnut) are viewed as the biggest UX challenge

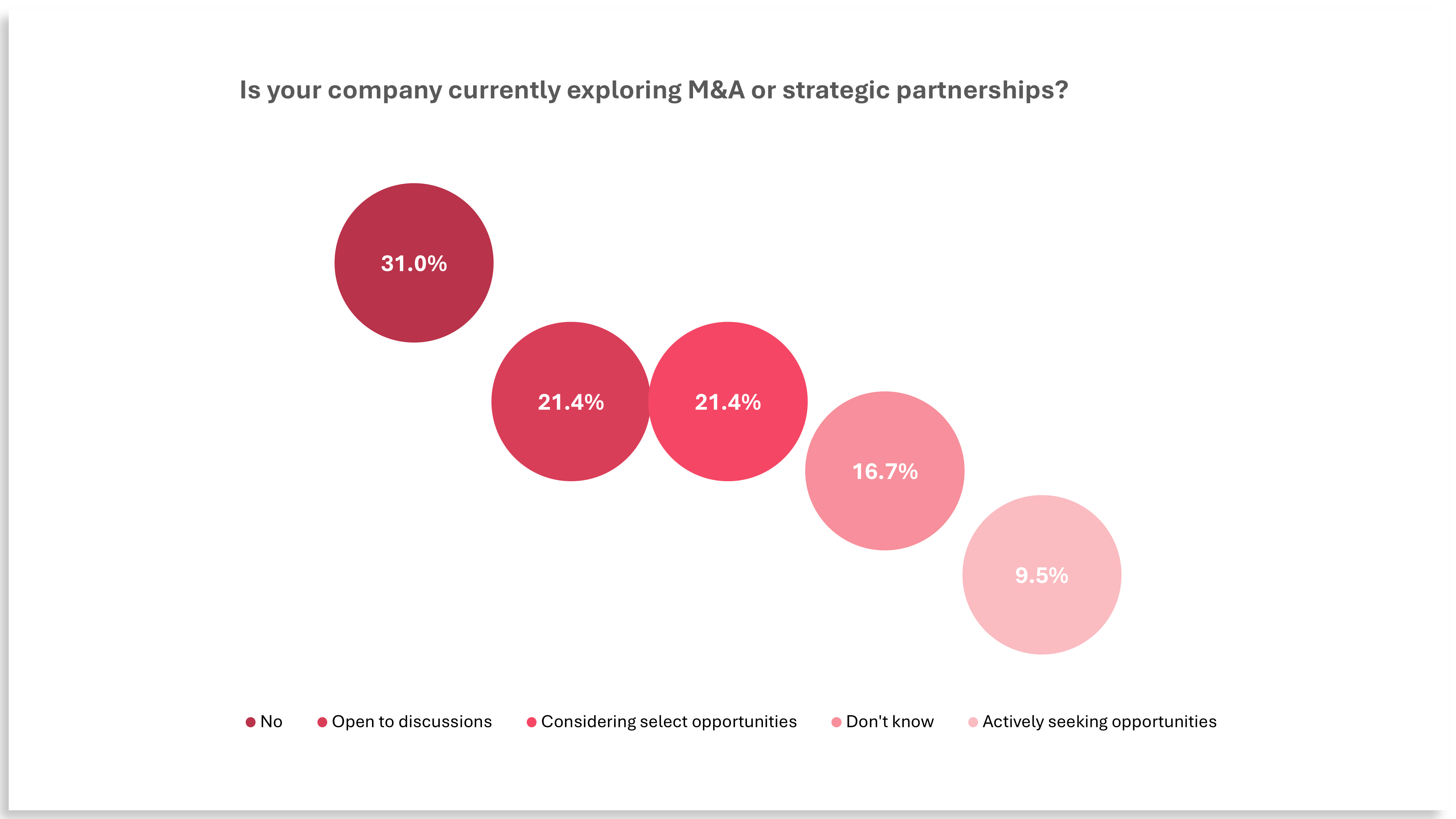

- 31% of companies are either open to M&A or actively seeking opportunities

- Only 60% have business continuity plans in place to address cybersecurity hacks

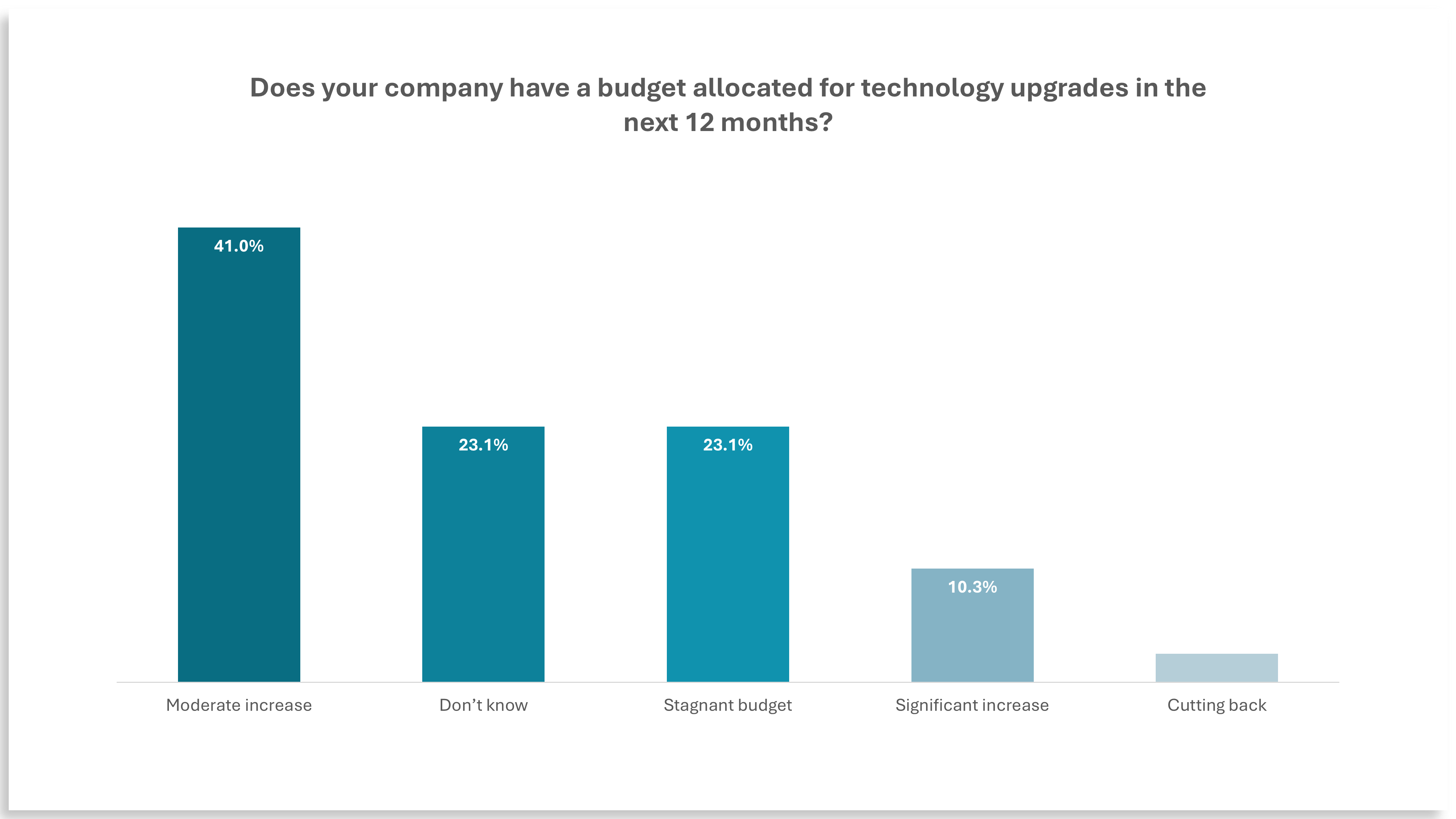

- 41% report a moderate increase in this year’s budgets specifically allocated to technology upgrades

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.