Kauser Kanji

VOD Pro

Share

Following Comcast’s £1.6bn bid for ITV’s Media & Entertainment (Broadcast) business, I’ve been looking at the broadcaster’s financial performance over the last few years. Why did Comcast offer that number – £1.6bn? I’ve written a separate post about that but in this piece, I’ve outlined some of the metrics the buyer would have looked at.

This data – from ITV’s full-year results documents, 2019-2024 – tells a fascinating story in its own right.

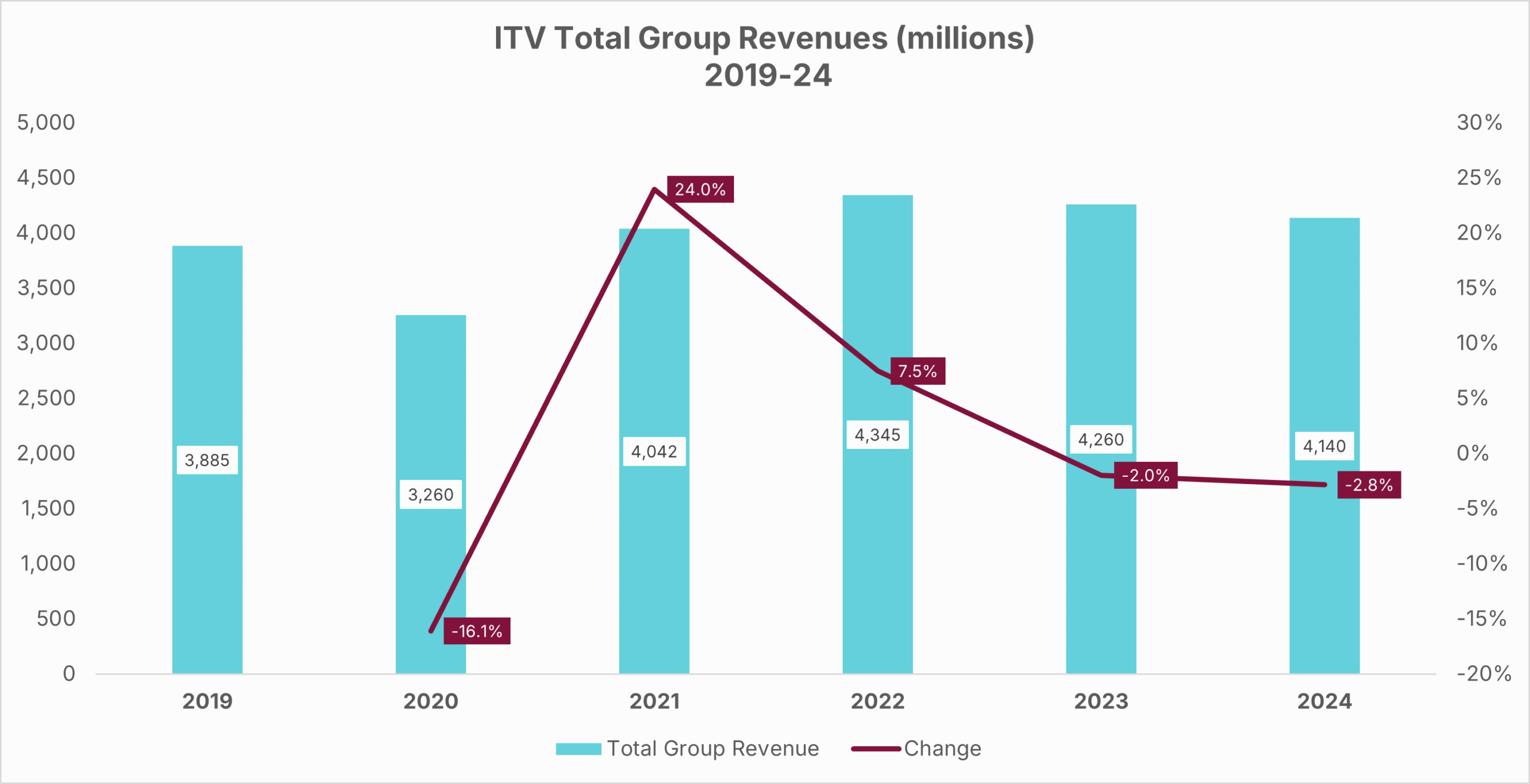

#1. Total Group Revenue

ITV has three revenue centres: M&E (which used to be known as Broadcast), M&E Non-Advertising Revenue (e.g. platform carriage fees, retransmission, licensing of channels, third-party affiliate commissions etc.) and the Studios business.

Across these six years, we can see that ITV is doing pretty well. Total group revenues grew 6.6% from £3.9bn in 2019 to £4.1bn in 2024.

Based on those numbers alone, you could say that ITV is certainly not a failing business. But, alas, when we factor in cumulative economic inflation over the same period (24%), we can’t say that it’s exactly succeeding either. In real terms, ITV’s 2024 revenues are about 14% lower than in 2019.

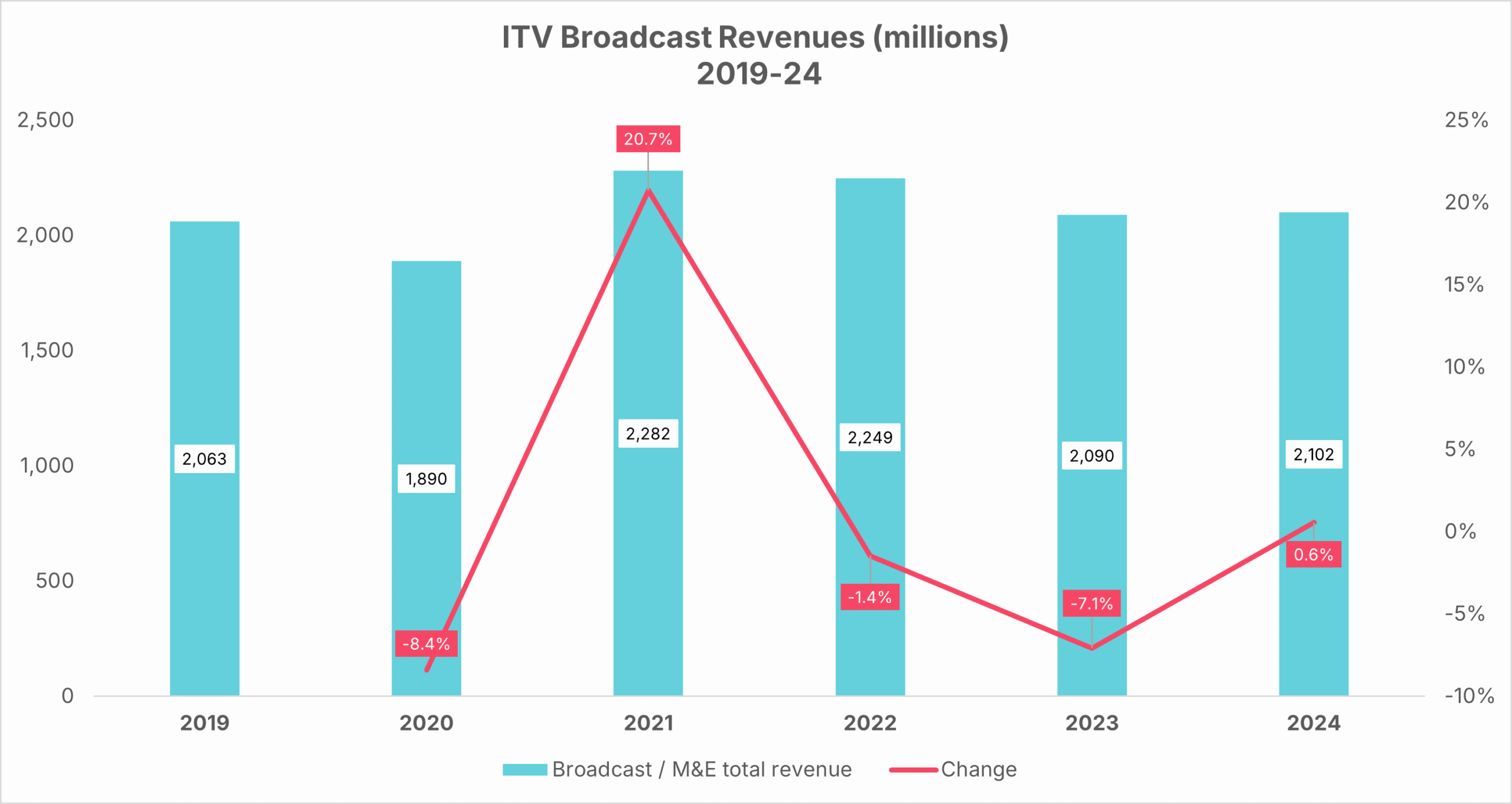

#2. Broadcast (M&E) Revenue

Inflation again haunts ITV’s M&E related revenues (including advertising and non-advertising income). Ostensibly, this is up 1.9% across the period but ITV would have needed around £2.56bn in 2024 broadcast revenue (instead of the actual £2.1bn) just to match 2019’s purchasing power.

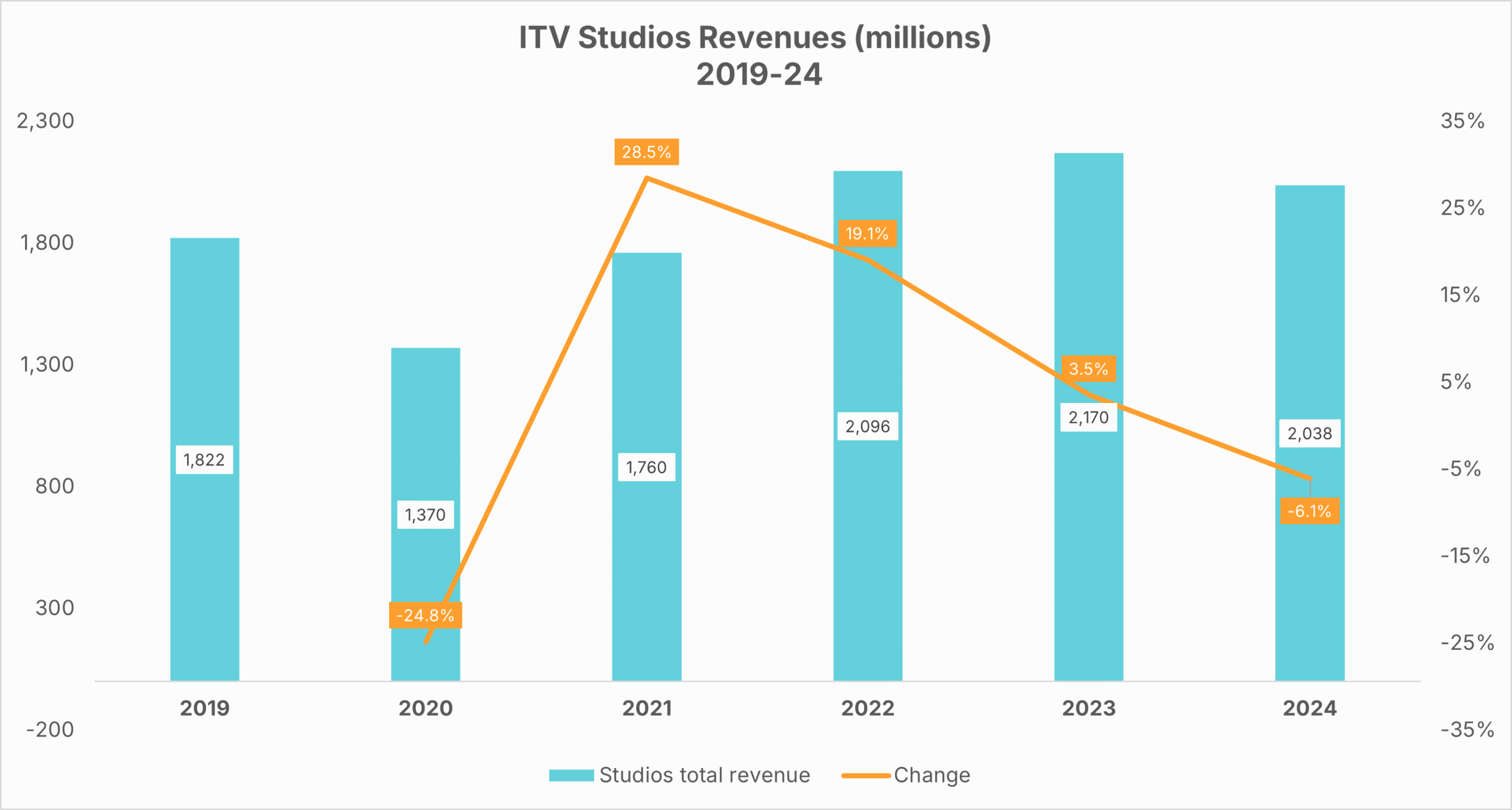

#3. Studios Revenue

With 11.9% growth from 2019 to 2024, ITV Studios is doing a little better. And while most production businesses have to live with volatility, the bigger picture here is one of recovery followed by plateau: a COVID hit in 2020, a strong rebound through 2022–23, and then a softening in 2024 as commissioning budgets tightened again.

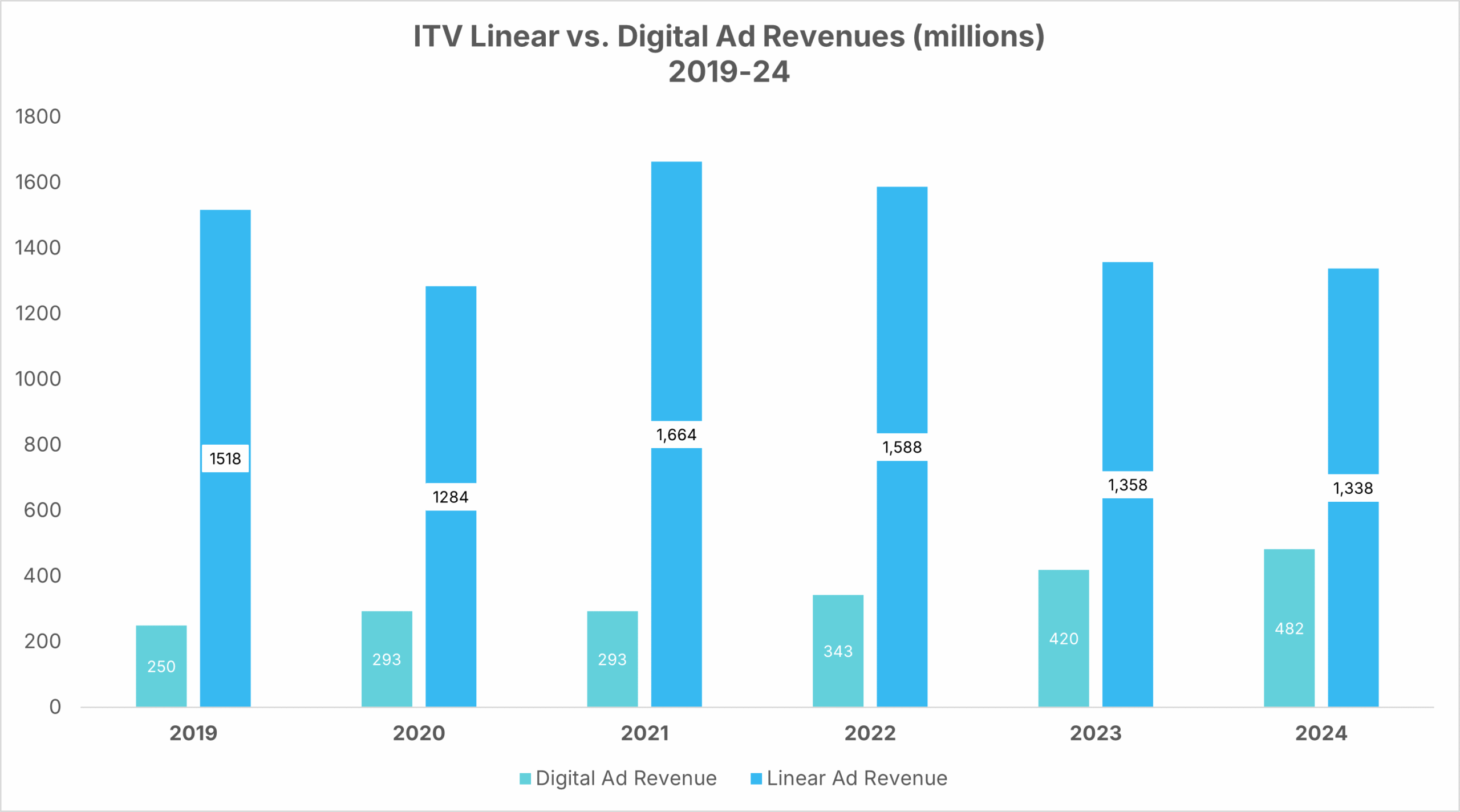

#4. Linear vs. Digital Ad Revenue

Like most ad-funded broadcasters, ITV used to live or die by the strength of its linear advertising revenues. As viewing shifted to streaming – and because Google, Meta and the social platforms were already hoovering up spend – digital growth rarely covered the linear declines. ITV is one of the exceptions. Between 2019 and 2024, linear advertising fell by £180m, while digital rose by £232m, more than filling the gap.

The flip, by the way, where digital started covering the linear shortfall was in 2023 (linear down £160m, digital up £170m).

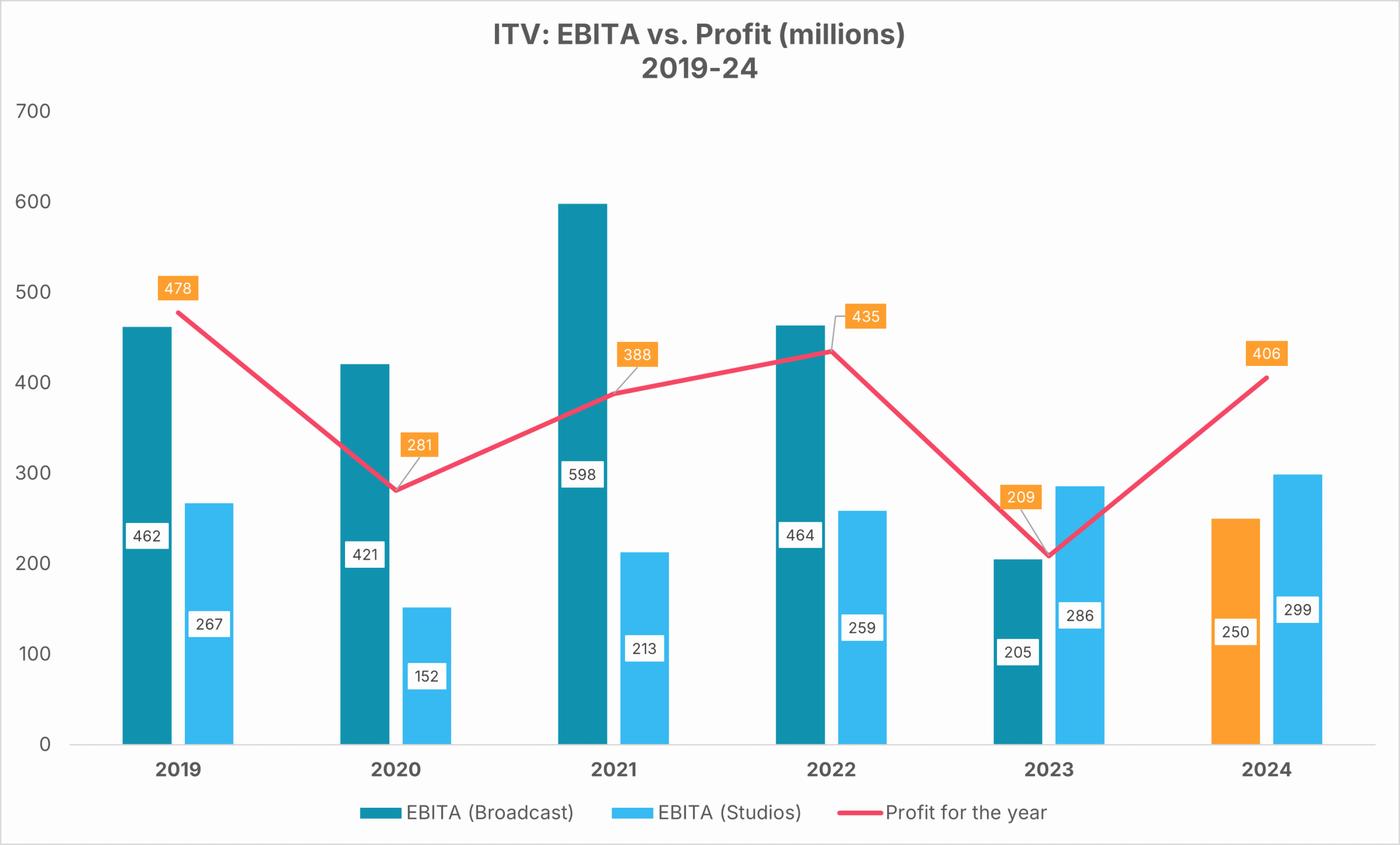

#5. EBITA vs. Profit

ITV’s EBITA picture over the six years is a story of disruption, recovery and reset. Broadcast EBITA fell sharply in 2023 before rebounding in 2024, while Studios has been the steadier contributor throughout. Profit for the year tracks the same arc: a Covid slump, a post-pandemic lift, then a drop as inflation and commissioning cuts bit in 2023. The 2024 Broadcast EBITA bar is shown in gold because this is the number Comcast may have used to make their £1.6bn bid for ITV’s M&E business last week (as I discuss in a separate post).

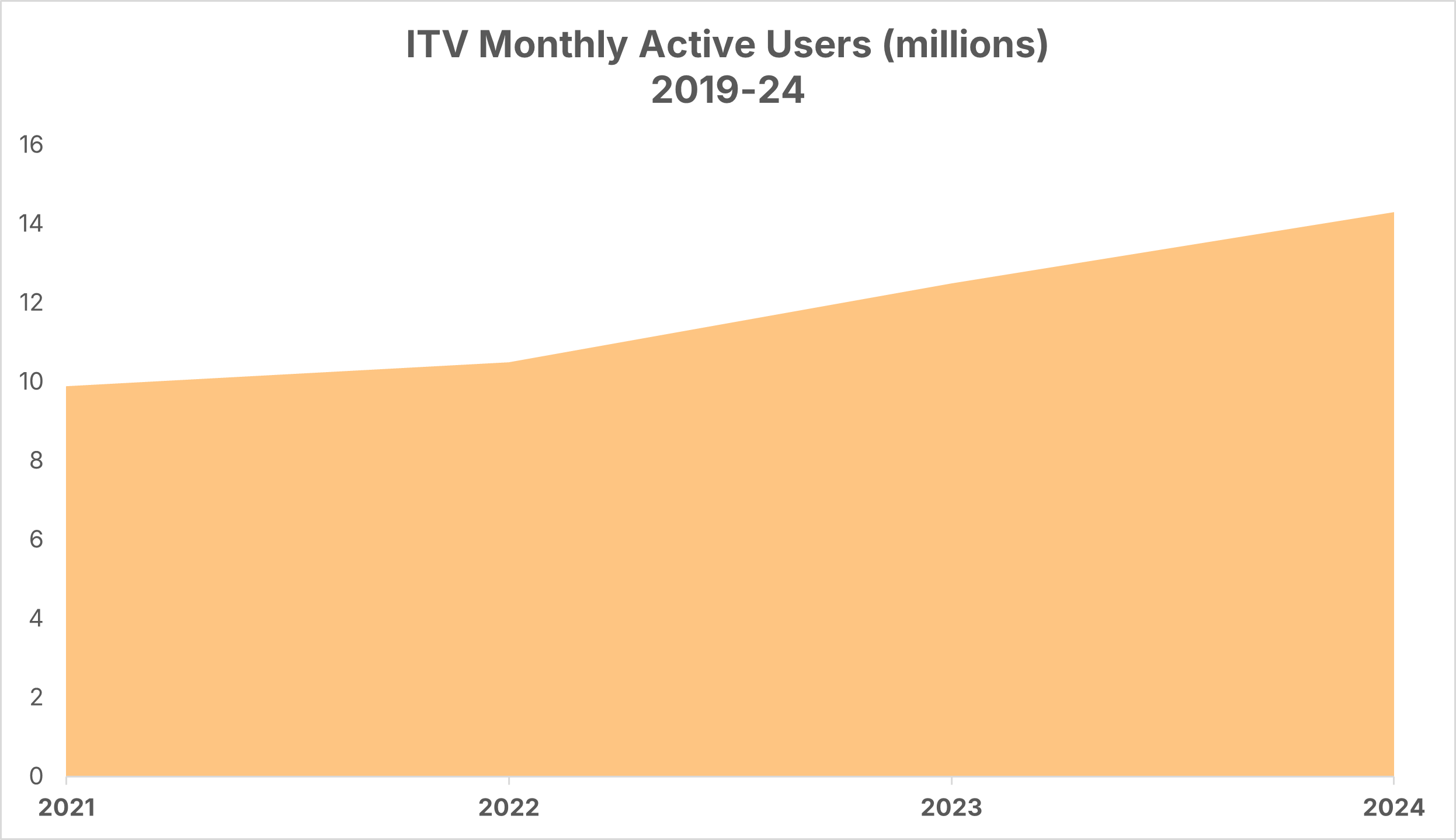

#6. Monthly Active Users

ITV only started reporting Monthly Active Users in 2021, switching from the much broader “registered accounts” metric (30.8 million in 2019 and 32.6m in 2020). Since then, MAUs grow steadily each year: up 6.1% in 2022 (to 10.5m), 19% in 2023 (to 12.5m) and 14.4% (to 14.3m) in 2024.

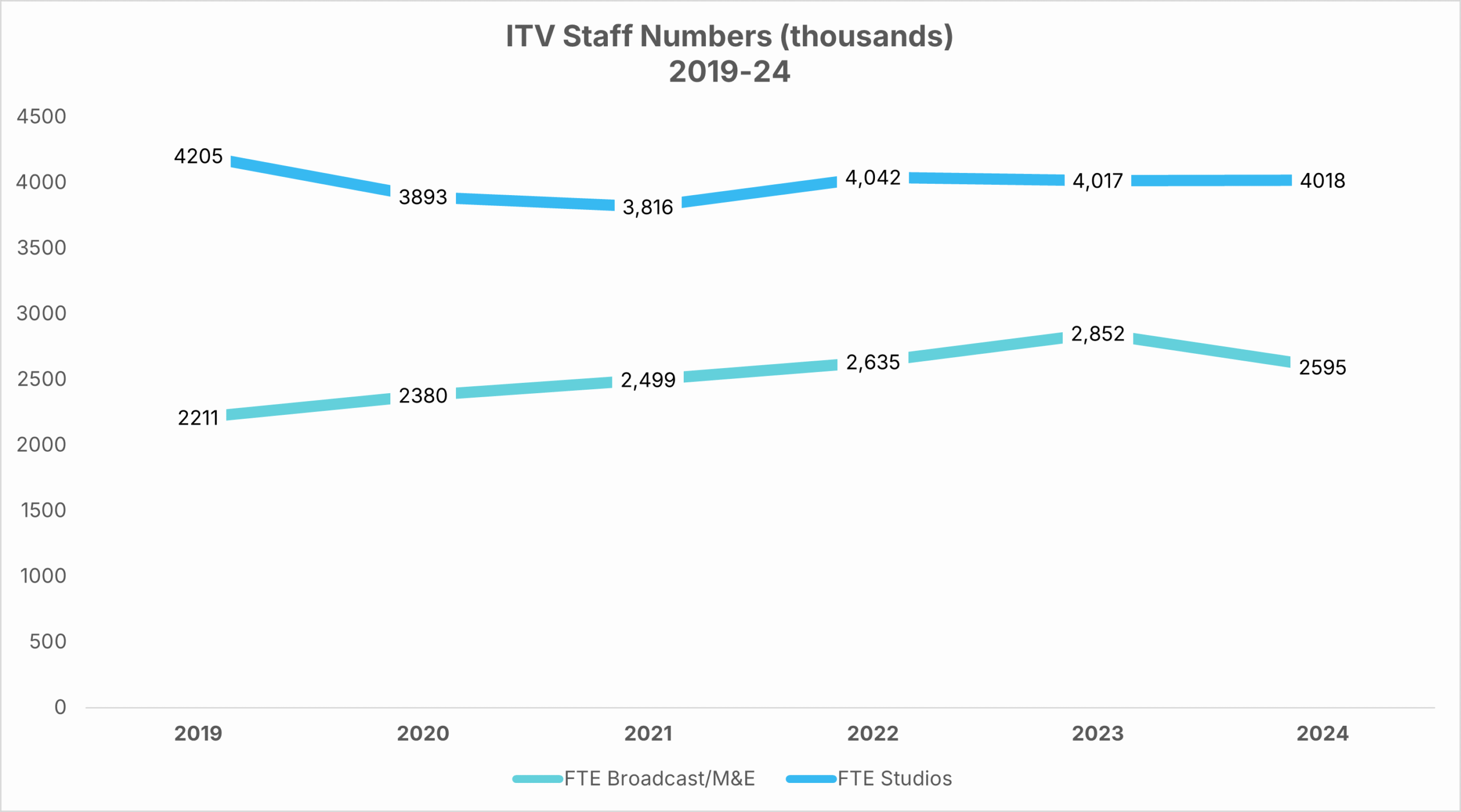

#7. Staff Numbers

Despite reporting cuts in 2024 and 2025, ITV’s staff numbers have remained fairly consistent over the period. Studios headcount drifts down slightly over the six years, from 4,205 to 4,018. Broadcast/M&E, by contrast, rises steadily from 2,211 in 2019 to a peak of 2,852 in 2023 before falling back to 2,595 in 2024.

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 20 years, formerly at Virgin Media and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.