Kauser Kanji

VOD Pro

Share

Comcast’s (opening?) bid for ITV’s M&E (Broadcast) business last week was… unexpected. Aside from feeling like a lowball offer, it was puzzling even to former ITV veterans. Peter Fincham, for example, who was Director of Television from 2008-2016, told BBC Radio that the relationship between the broadcast business and ITV Studios was symbiotic.

Together, “two plus two equals five. There’s a slight risk in this that you separate the two and… you end up with the joint value of three.”

So why did Comcast bid only for one part and not the other? Why did they bid what they did – £1.6bn? And how did they arrive at that number?

I’ve been talking to some senior industry people about this and have jotted down some thoughts.

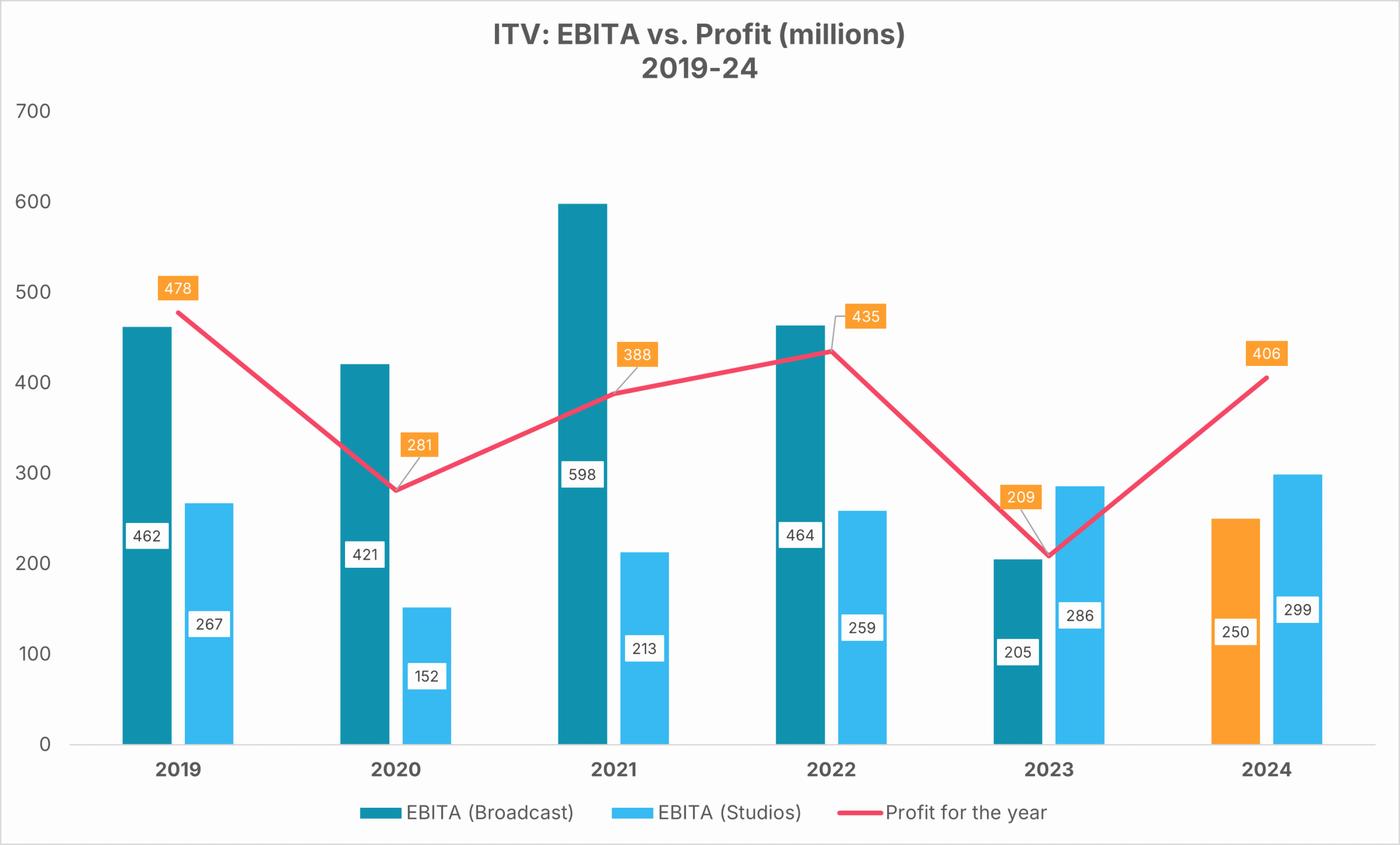

Oh, and I’ve also been looking – in some detail – at ITV’s year-end results from 2019-24. You can see my analysis of those figures here.

#1. The Top-Down Valuation Approach

When a buyer like Comcast assesses a business, one quick and dirty method is to take last year’s earnings (or EBITA) and apply a multiple. In the case of ITV’s M&E arm, the adjusted EBITA for 2024 was approximately £250 million. Multiply by 6.4 and you get 1.6bn.

That sits reasonably well with market precedent: one exec I spoke to who’s working on a similar-ish deal (albeit much smaller) told me that their buyer was offering x8.

This kind of top-down approach, however, treats the business as if only the core operating profit matters – it effectively values at zero several strategic and intangible assets (which we’ll explore in Section 2). That means the headline is neat, but the detail hides what the buyer assumes won’t add incremental value to the deal (or is too uncertain to justify paying more).

#2. A Bottom-Up Asset Valuation Approach

The alternative to top-down is, of course, bottom-up where you start adding up everything the business owns or controls: the recurring cash flows, the brand, the platform, the data, the tech, the licences. In more detail:

- The Broadcast business alone delivers around £250m EBITA. Using the more generous 8x multiple, that could justify a starting point £2bn valuation

- Then you layer on the additional assets that Comcast’s bid effectively valued at zero:

- A national free-to-air broadcaster with a third of UK commercial viewing share

- A streaming platform (ITVX) with 14 million monthly actives and growing digital ad revenue

- First-party viewer data and 30m+ registered accounts

- A proprietary ad-tech platform (Planet V) embedded with agencies

- The privilege of broadcast licences and EPG prominence

- And a brand with decades of heritage

When you value each of those separately – let’s say £500m-£1bn for the platform/data/tech bundle + same again for brand/licences – you push the total valuation of the business well into the region of £3bn+.

That means the £1.6 billion bid is not just a low multiple, it’s a lowball when you consider the full stack of what the business controls.

#3. What Happens Next?

As if this piece wasn’t speculative enough already, here’s how the dynamics might now play out:

- We know that ITV didn’t flat-out reject the bid. Why? Well, firstly, it can’t – it has a fiduciary duty to consider it. It also needs to canvass opinion from shareholders and analysts. And it gives ITV time to test regulatory reaction. There would be two regulators involved here – the Competition and Markets Authority (CMA) and Ofcom. If they reject the possibility of Comcast buying ITV, the bid is dead in the water. On the other hand, if they don’t completely trash it, but instead signal major hurdles, Comcast would have to decide whether to walk or raise.

- Why is the regulator a major wildcard? Because if Comcast’s Sky/Broadcast combination absorbs ITV’s ~33% share of commercial viewing, the merged entity is set to control around 70% of the UK television advertising market. That degree of concentration triggers competition and plurality concerns, making regulatory clearance far from assured.

- So ITV’s play here is to engage but not commit. They might hope to draw other bidders out of the woodwork and leverage Comcast’s interest to extract a better outcome. In the meantime, if they get a (tentative?) thumbs-up from the regulators, it’s at that point that they can (if they choose to) reject Comcast’s initial bid in the hopes of securing a better offer.

Summary

In short: Comcast’s valuation is defensible if you assume that only the core cash flows matter – thus the x6.4 multiple. But if you acknowledge the strategic value of platform, data, tech, brand and licences, then the bid looks conservative.

The next phase of this story hinges less on whether the maths adds up and more on whether the regulator(s) will allow the deal and ITV can trigger a wider bidding process.

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 20 years, formerly at Virgin Media and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.