Kauser Kanji

VOD Pro

Share

Whenever Netflix’s latest financials are published, the topline data is always the stuff the press focuses on: revenue, content spend, subscriber numbers. Totally understandable, obviously: they tell a story about the health, performance and strategy of the company.

But what’s just as important – to me at least – is what Netflix spends on technology, marketing and general admin. What can we learn from those numbers both for how the streamer itself operates and for other OTT service-providers?

Some thoughts based on Netflix’s 2019-2024 published budgets.

#1. The Industrialisation of Streaming

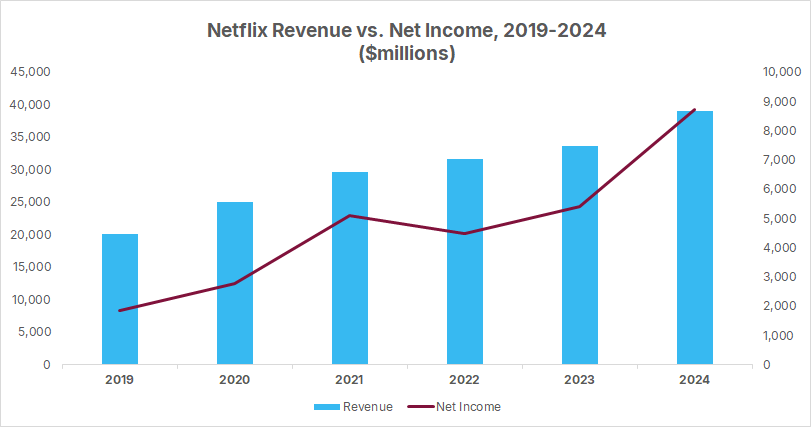

In 2019 Netflix generated $20 billion in revenue and $1.9 billion in profit. By 2024, revenue had doubled to $39 billion but profit had quadrupled to $8.7 billion.

What this tells us, I think, is that Netflix is starting to behave like a well-run manufacturing business: predictable inputs, scalable processes, repeatable margins.

For years the company chased new markets. Now it’s optimising the machine – tuning pricing, advertising, and engagement loops rather than chasing the next 10 million subs.

#2. Reduced Marketing Costs

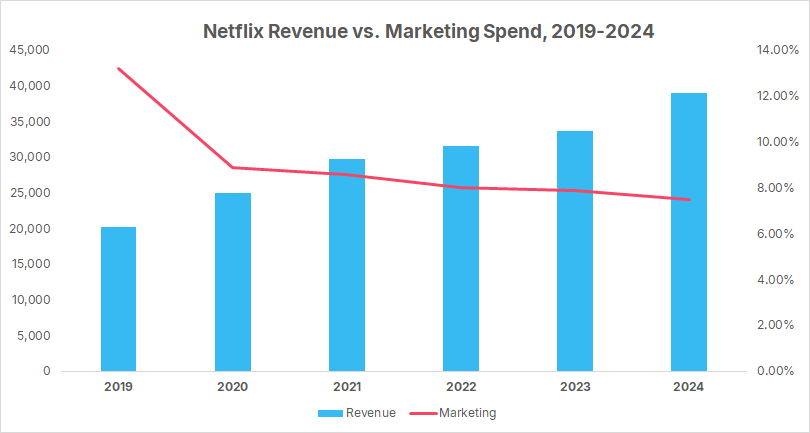

In 2019 Netflix spent 13% of its revenue on marketing – about $2.6 billion. By 2024 that ratio had almost halved to 7.5%, even though absolute spend barely changed.

That’s quite something. It means Netflix added nearly $19 billion in extra revenue without meaningfully increasing its marketing budget.

How? We know that Netflix prides itself on being a data-driven company. And the brand is, by now, totally ubiquitous (if not loved in quite the way it was in the days of Netflix ‘n chill). We can also infer that marketing is done via playbook – a honed, repeatable process.

But the real trick, I suspect, is that Netflix has turned product into promotion. The interface is the marketing: algorithmic placement, automated trailers, endless testing. It’s all internal now. You open the app and the campaign is already happening.

#3. Tech as IP, Not just Plumbing

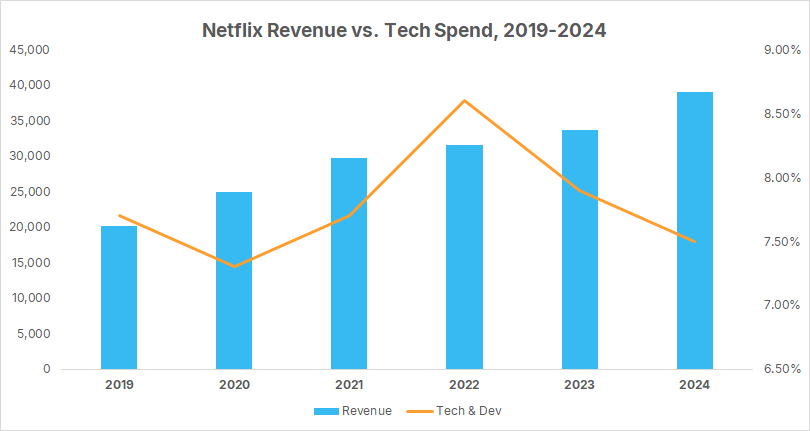

Technology & Development spend rose steadily from $1.5 billion in 2019 to $2.9 billion in 2024 – roughly 7-8% of revenue every year.

Some of this, we can attribute to content delivery: the more customers, the more they watch, the greater the streaming costs.

But the consistency in sticking to a 7-8% spend is the point. Netflix treats technology as a value generator, not a cost centre. The recommendation system, encoding algorithms, localisation pipeline, and cloud infrastructure are all proprietary assets that drive margin.

#4. Admin Discipline and Operating Leverage

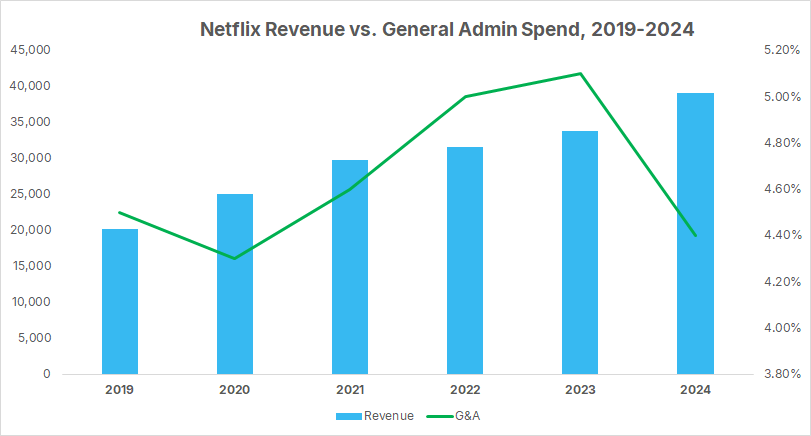

General & Administrative costs- the lawyers, finance teams, offices – grew from $0.9 billion to $1.7 billion over six years. Sounds big, but revenue nearly doubled, so the share stayed flat around 4–5%.

That’s operating leverage in practice: fixed infrastructure supporting ever-larger output.

Netflix didn’t get there by cutting staff alone (it actually only cut about 5% of its workforce in 2022); it got there by building scalable systems. Once the finance, rights, and metadata frameworks are in place, every new market or title adds incremental, not exponential, admin work.

#5. Overall Efficiency Gains

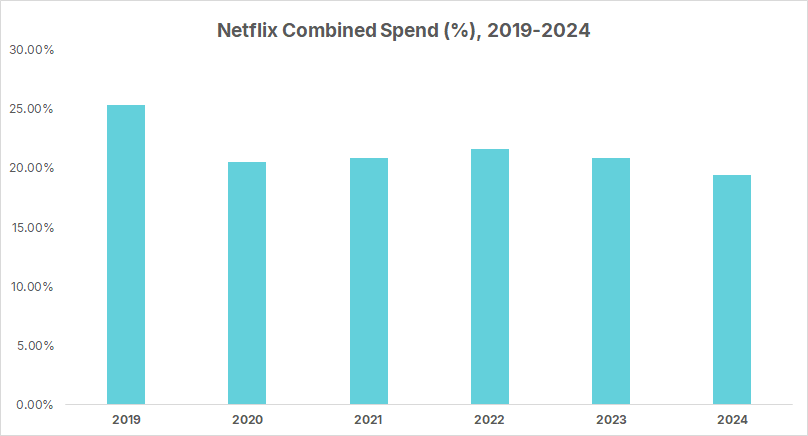

Marketing, Tech & Dev, and G&A together fell from 25% of revenue in 2019 to under 20% in 2024, showing clear scaling efficiency.

That kind of shift doesn’t happen by accident. It means every extra dollar of revenue is now costing Netflix less to earn – the hallmark of a company that’s learned to compound its own advantages.

What This Means for Everyone Else

So should ITV, Channel 4 or Disney aim for the same 7-8% tech spend or 7% marketing ratio? Not exactly. Netflix’s structure makes its cost base unique. But they could (arguably should) pay attention to the direction of travel:

- Marketing efficiency improving every year

- Tech investment steady and strategic, not stop-start

- Admin scaling slower than revenue

Those are universal indicators of maturity.

Thoughts? DM me on LinkedIn.

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 20 years, formerly at Virgin Media and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.