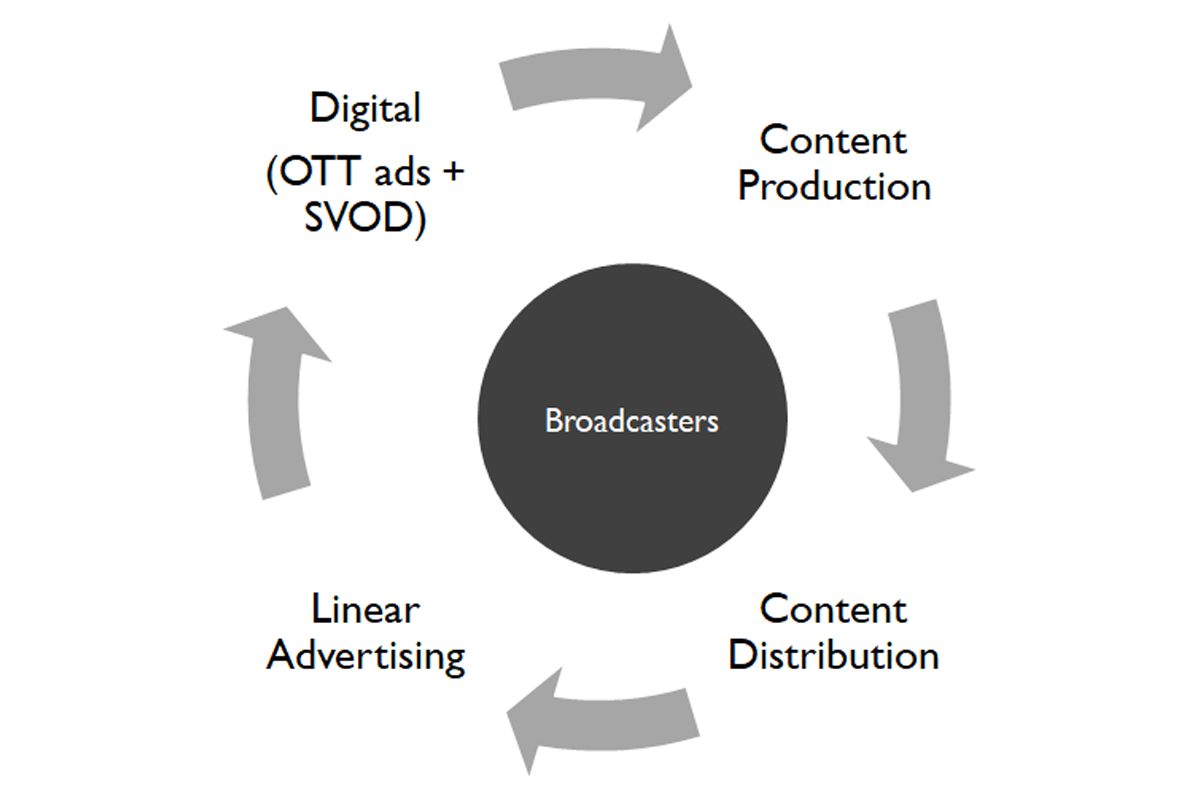

The world’s biggest broadcasters usually have four main revenue streams:

- Content production – which is either commissioned independently, in partnership, or self-funded;

- Content distribution – the content is sold to other broadcasters, perhaps in other territories, or aggregators like Amazon and Netflix;

- Digital revenue – which comes from digital advertising (AVOD) or subscriptions (SVOD);

- And linear advertising income which has traditionally been the biggest pot.

Together, these revenue streams form something of a virtuous circle –

The more income that is generated, the more money there is to invest in content production; the more content that’s produced, the greater the opportunity of creating hit shows / movies which can then be effectively monetised. And so far, overall revenues – at least for major broadcasters – have remained robust.

In the UK, for example, both ITV and Channel 4 have seen their revenues increase by, respectively, 34% and 7% from 2013 to 2018. In Germany, the RTL Group has posted a 12% upturn over the same period whilst TV4 in Sweden has registered a 13% rise. And in the US, CBS’s income has gone up by 14%.

Note: Discovery’s huge revenue growth includes the acquisition of the Scripps Network in 2018.

The problem for broadcasters, however, is that audiences all over the world are watching less live TV than before and so concomitant linear advertising revenues have also diminished. Again, looking at 2013 – 2018, Channel 4’s linear ad income is down 3.4%, CBS’s is down 17.7%, and the Canadian Broadcasting Corporation’s is down 12.7%.

So, how quickly is linear advertising revenue falling? Obviously, that depends on the broadcasters you study but using my sample above, it looks like average revenue has decreased by 8.5% over the past six years and 0.7% in the last three (and that’s only because CBC had a great 2018 compared to 2016. If we remove them from the equation, the three year variance is minus 5.98%).

And sure, digital revenues are climbing but they’re not growing quickly enough to bridge the gap.

It’s instructive to note that of the ten national and international broadcaster’s finances that we studied this year (CBC, CBS, Channel 4, Discovery, ITV, RTL, SRG SSR, TV4, UKTV and Viacom), only the three above have reported their digital revenues. This suggests that for most broadcasters, digital performance has not been strong enough to merit much publicity – especially in the context of financial statements. Perhaps it’s no coincidence then that in its 2018 financial results, ITV has stopped referring to “Online, Pay and Interactive” as a separate revenue stream.

It’s going to be interesting to see how this plays out over the next few months. If linear revenues continue to decline by say 4%, that doesn’t mean that the virtuous circle has 25 years until it completely breaks down. Less income may lead to less content production which, in turn, may diminish the depth of broadcaster’s other sales channels.

Any thoughts? Drop me a line.

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.