In our recent OTT Question Time about Disney vs. Netflix, Alan Wolk of TVREV told us that although technically Disney had more subscribers than Netflix (222.1m vs. 220.7m) that might not be the best metric for comparing the two companies. Why? Because over a quarter of Disney’s customers came from Hotstar in India and their average ARPU ranged from just 57 cents a month to $3.76 a month – a high rate of variability.

Is ARPU, then, a better metric than raw subscriber numbers? How do we measure ARPU for other OTT pay models? And how do we gauge ARPU in the context of free trials and churn? That was the topic of this week’s OTT Question Time.

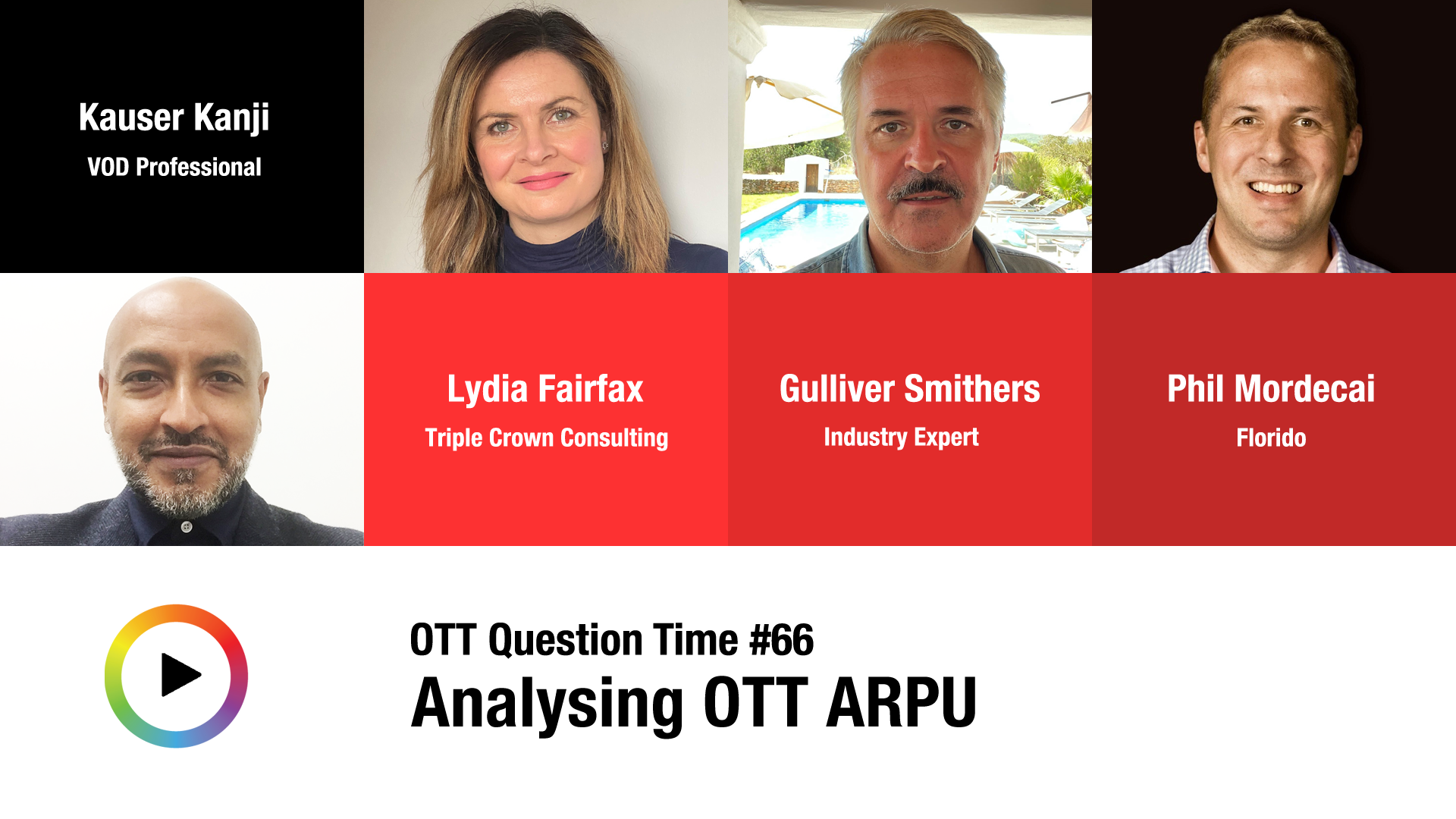

Together with Lydia Fairfax, former SVP Commercial Partnerships EMEA at Discovery and now a Media Consultant and Founder of Triple Crown Consulting, Phil Mordecai, MD of Florido, and Gulliver Smithers, former SVP Product & Technology at Sony Pictures, we discussed:

- • How ARPU compares to other OTT metrics (e.g. subscribers, viewers etc.)

- • How to compare SVOD ARPU vs. AVOD ARPU vs. FAST ARPU

- • Netflix ARPU vs. Amazon ARPU vs. Disney ARPU

- • How to model ARPU

- • And, of course, how to increase ARPU

Watch the video below!

**

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.