The latest research from Ampere Analysis confirms the growing global demand for movies, despite radical changes in the entertainment industry. Global consumer spending on movies has grown by nearly 30% over the past decade, encompassing theatrical/cinema, home entertainment*, premium pay TV and subscription OTT. And most film fans use more than one way to consume movies.

The main drivers of the market’s ongoing expansion are theatrical – with notable growth in Asia compensating for declines in the home entertainment market – and subscription OTT, which increasingly represents one of the most accessible ways that consumers can easily watch films.

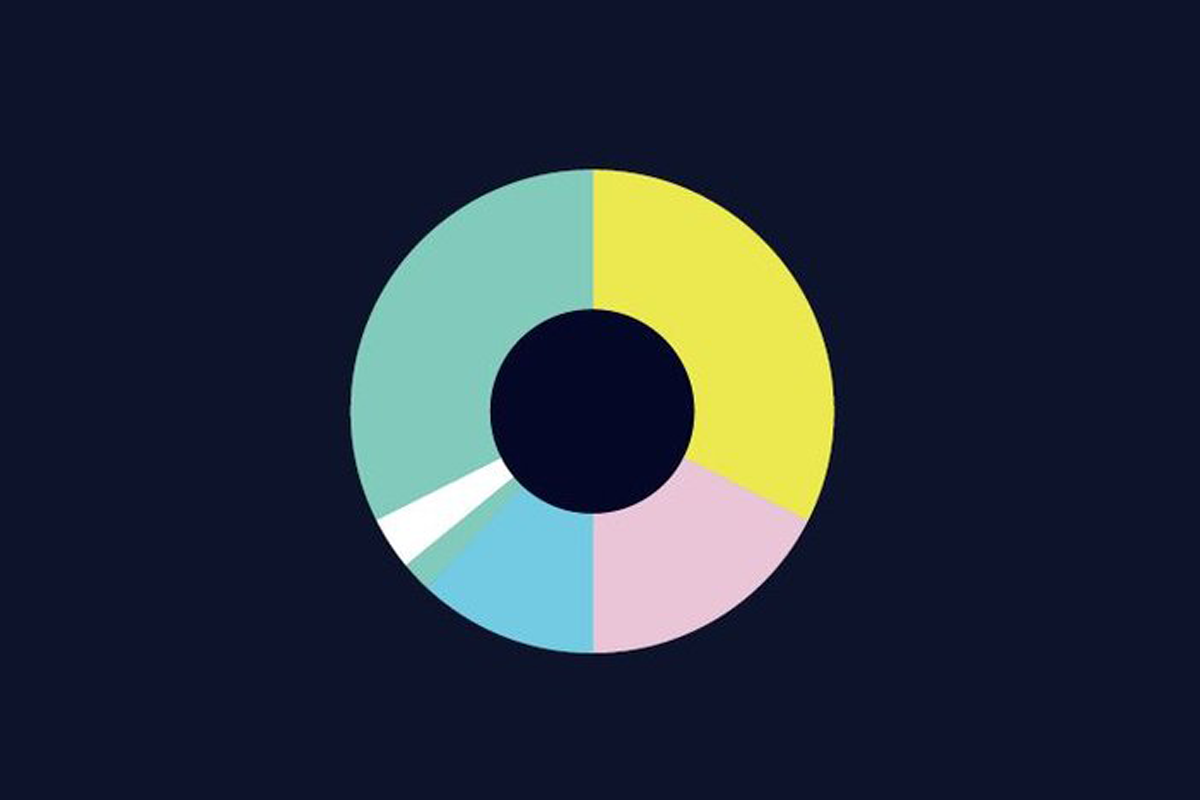

An enduring feature of the movie market is the fact that consumers don’t typically just rely on a single way of consuming films. 11% of Internet users are classified by Ampere Analysis as super-fans. This group visits the cinema to watch the latest films, rents and buys movies released on DVD/BD or via digital stores, subscribes to premium movie channels via their pay TV operator and takes subscription OTT offering large catalogues (of often slightly older titles). The ability of the industry to drive meaningful spending across each segment of the market demonstrates the power of windowing to monetise film content.

Theatrical is main driver of movie market

- Almost one half (~46%) of the value of the global movie market in 2019 was from theatrical movies, at over $40 bn in box office takings in 2019.

- Two core factors have driven global growth: increase in volumes of cinema admissions in emerging markets such as China and India, and increased ticket prices in developed markets offsetting admission declines.

- Across the 22 markets surveyed by Ampere Analysis, between 40% and 80% of 18-64-year old consumers go to the cinema at least once in a six-month period.

- 75% of consumers use more than one medium to watch film. Most commonly, they combine going to cinemas to watching movies on subscription OTT services. 45% of Internet users across the surveyed markets mix cinema-going with using a subscription OTT service like Netflix or Amazon.

- Despite the increased availability of competing content to watch, as Ampere Analysis has previously observed, there is little direct correlation between uptake of OTT services, such as Netflix, and declines in theatrical admissions.

- Home entertainment and premium pay TV are both losing share. However, Ampere Analysis estimates that home entertainment’s decline may bottom out in 2-3 years as online purchase and rental models compensate for the ongoing decline in DVD/BD sales.

- 11% of Internet users are movie super-fans, consuming film through all media. Those who rent or purchase film are more likely to also use other forms of media to consume film, illustrating the ongoing power of windowing in monetising the same consumers multiple times over.

Studio direct-to-consumer strategies will determine the future of the movie market

The launch of major studio-led direct-to-consumer services is likely to be one of the biggest factors influencing how the movie market develops over the next five years.

Major studio film titles have historically represented a key part of premium movie channel schedules. In markets like the UK, half of movie schedules on Sky Cinema channels in Q3 2019 were devoted to films from just three US studio groups.

Similarly, Subscription Video on Demand (SVoD) players have been key buyers of rights for US major film titles. But the studios are pulling back, ring-fencing their content for their own direct-to-consumer (D2C) services such as Disney+.

Studio windowing strategies hold significant weight in how the home entertainment market will evolve too. Although movie purchasing/renting has been a sector in long decline, as the physical market bottoms-out, digital transactional services have the potential to return the sector to growth. But if content windows are adjusted by studio groups to prioritise incentivising consumers to sign up for the new D2C services, this could dampen any possible recovery in the market segment.

Richard Broughton, Director at Ampere Analysis says: “Although the global movie market has grown over the last decade, the way consumers buy film has altered dramatically. As the home entertainment market has dwindled, consumers have spent more of their disposable income on premium pay TV channels and, more recently, on subscription OTT services. The biggest disruption to the way the market works however, could be driven by the studios themselves. The launch of D2C services holds the potential to alter the end market for movies permanently. We would advise film distributors and producers to be careful to keep hold of the unique resource which the film industry has at its disposal, and which has made it so successful at monetising content over the past decades – windowing.”

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.