The number of people with more than one online streaming service is continuing to grow according to the latest consumer research from Ampere Analysis. In a survey of 33,000 internet users across 16 countries, more than half (50%) of respondents in 13 of those countries had at least one SVOD service, while in 10 of the 16 markets, more than half of SVOD homes were SVOD Stackers – those taking more than one service. As more major players – such as Disney – enter the SVOD marketplace in 2019 and beyond, the billion-dollar question is, just how many services will consumers pay for?

Findings

- Netflix continues to be the dominant service, leading in almost all countries surveyed in terms of the number of subscribers

- Amazon Prime only beats Netflix adoption levels in Japan and Germany – and even here, Netflix is the second choice

- This is not just a marketplace where just two global SVOD giants battle for supremacy. Local players perform well in Sweden, Turkey and the Netherlands, and elsewhere, others are eyeing the market opportunity.

SVOD Stacking: The trend is up, but each market does it differently

France: With one of the lowest uptakes of SVOD, Netflix and Amazon hold pole positions as French broadcaster-led services struggle to compete, hampered by strict rules and quotas. Despite these challenges, stacking is growing: one in three respondents subscribe to more than one service.

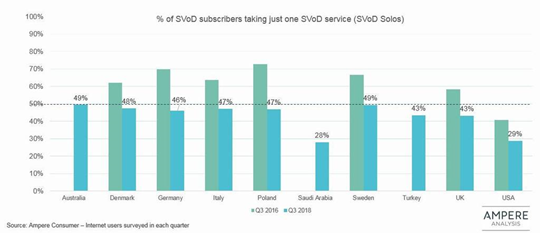

Germany: In Q3 2018, SVOD households taking more than one SVOD service overtook those taking just one for the first time in Ampere survey history.

Netherlands: Netflix adoption in SVOD homes is above 90%. The launch of Amazon Prime delivery has doubled those using the SVOD service, and stacking has increased. One in three SVOD homes take two or more services.

Poland: More than half of SVOD households stack, although no package combination dominates.

Spain: Stacking has reached an all-time high in Spain, and HBO Espana has quickly become the third-ranked player after Netflix and Amazon Prime. As stacking increases, Spanish operators are increasingly integrating SVOD into their set top boxes, so this behaviour is likely to grow.

Sweden: Netflix is the most popular service, although local players are enjoying consistent growth. By Q3 2018, more than half of SVOD households had more than one subscription.

Turkey: Netflix’s local interface has boosted SVOD adoption, allowing it to co-exist happily with local services. The number of consumers taking one service is declining – three seems to be the magic number in Turkey, although none of the numerous local players is dominant.

UK: New D2C services such as ITV Hub+ have boosted SVOD stacking, with ITV Hub+ respondents subscribing to an average of 4.4 services in Q3 2018. 43% of SVOD households are Solos, down from 60% in Q3 2016.

US: Here there are two and a half times as many SVOD stackers than SVOD Solos. Netflix is practically ubiquitous, appearing in the top three subscription portfolios, with 90% of Hulu subscribers also taking Netflix.

Toby Holleran, Senior Analyst at Ampere Analysis says: “The growth of SVOD subscribers taking multiple services shows that while Netflix and Amazon dominate many of the markets surveyed, they form the foundation of many stacks, serving as gateway services for consumers who then choose additional subscriptions to curate content. Niche and broadcaster-led services are capitalising on this trend, with ITV Hub+ in the UK seeing strong growth in 2018 and broadcaster-led services in Sweden, Spain and Italy also on the rise. Disney’s pending US streaming service might find a home in the portfolios of the heaviest of stackers but could find itself having to de-seat other services in the more established SVOD stacks as the US market reaches maturity.“

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.